AI Agent Guardrail for Financial Institutions

Trust Your AI. Protect Your Business. Comply Without Compromise.

AI agents and Gen AI are reshaping finance by enhancing customer experience, speeding up decisions, and powering trading. But powerful AI needs powerful protection.

Beam9 hardens your AI against threats, compliance risks, and bias at enterprise scale.

Your Risks Are Growing So Must Your Defenses

Prompt Injections and Jailbreaks

Attackers can manipulate AI agents to bypass security restrictions, potentially triggering unauthorized transactions or misleading financial guidance.

Adversarial Manipulation

AI-powered trading and risk models can be hacked or biased by bad actors, leading to fraudulent activities and financial mismanagement.

Data Leaks and Privacy Violations

AI agents handle PII, trading strategies, and financial forecasts– any leakage could be catastrophic for compliance and customer trust.

Security Compliance Requirements

AI-generated financial advice must comply with SEC, FINRA, PCI-DSS, GDPR, and NYDFS regulations.

Lack of Transparency

in Gen AI’s decision-making raises auditability concerns.

Bias and fairness issues

in AI-driven lending or credit scoring models can lead to compliance violations.

How Beam9 Protects AI Agents in finance

Beam9 acts as a security and compliance layer between AI agents and financial users, ensuring that every AI-generated response is safe, explainable, and compliant.

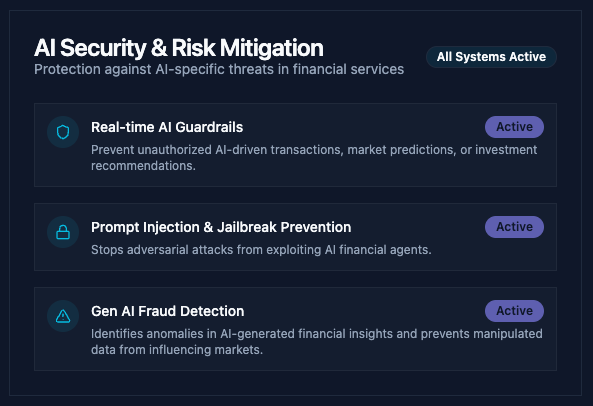

AI Security & Risk Mitigation for Financial AI Agents

Real-time AI Guardrails

Prevent unauthorized AI-driven transactions, market predictions, or investment recommendations.

Prompt Injection and Jailbreak Prevention

Stops adversarial attacks from exploiting AI financial agents.

Gen AI Fraud Detection

Identifies anomalies in AI-generated financial insights and prevents manipulated data from influencing markets.

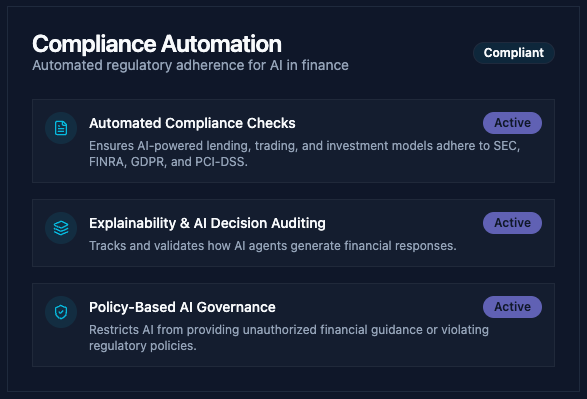

Compliance Automation for AI in Finance

Automated Compliance Checks

Ensures AI-powered lending, trading, and investment models adhere to SEC, FINRA, GDPR, and PCI-DSS.

Explainability and AI Decision Auditing

Tracks and validates how AI agents generate financial responses.

Policy-Based AI Governance

Restricts AI from providing unauthorized financial guidance or violating regulatory policies.

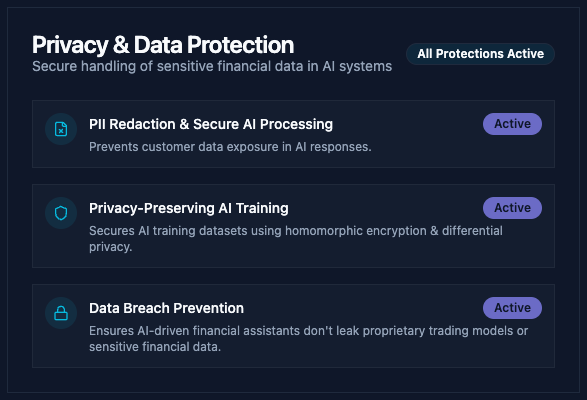

Privacy & Data Protection in Gen AI Finance

PII Redaction and Secure AI Processing

Prevents customer data exposure in AI responses.

Privacy-Preserving AI Training

Secures AI training datasets using homomorphic encryption & differential privacy.

Data Breach Prevention

Ensures AI-driven financial assistants don’t leak proprietary trading models or sensitive financial data.

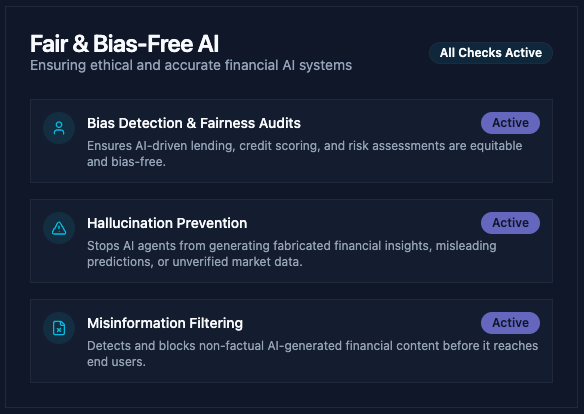

Fair, Transparent & Bias-Free AI Agents

Bias Detection and Fairness Audits

Ensures AI-driven lending, credit scoring, and risk assessments are equitable and bias-free.

Hallucination Prevention

Stops AI agents from generating fabricated financial insights, misleading predictions, or unverified market data.

Misinformation Filtering

Detects and blocks non-factual AI-generated financial content before it reaches end users.

How Beam9 Works

Our plug-and-play security layer integrates with AI agents, Gen AI models, and financial AI workflows to:

Stop adversarial AI attacks

with real-time security guardrails

Ensure AI compliance

with automated regulatory enforcement

Monitor and govern AI performance

to prevent risks before they happen

Seamlessly integrate with any AI model

OpenAI, Google, Anthropic, and financial AI applications